Exelon’s troubled nuclear fleet ran into still more trouble Friday, when three of its nuclear sites–totaling four reactors–failed to clear the PJM capacity auction for 2018, despite PJM’s efforts to bolster big-time nuclear and coal generators.

The three losers were the two Quad Cities reactors, Three Mile Island and Oyster Creek. Another Exelon reactor that is bleeding money is Clinton, in downstate Illinois, which is not part of the PJM service area.

Failing to clear the auction does not necessarily mean that these reactors will close, nor, for that matter, that they are even uneconomical. Although, in this case, they are either losing money or barely breaking even.

The capacity auction is held by PJM to ensure a reliable source of power during peak demand periods, like during the recent polar vortex and on the hottest of summer days. Utilities bid a price to PJM that they will accept to guarantee that their power plants will be operating during those times, during that span–June 2018-June 2019. Once PJM has what it considers adequate capacity, power plants whose bids are higher than the last plant bidding successfully are said to fail the auction and PJM will not count on them operating.

However, utilities with power plants that fail the auction can still attempt to, and often do, sell their electricity on the open market. In addition, local transmission constraints can sometimes force regulators to keep power plants open even if they have not cleared the auction. These local grid issues can become quite political and used to keep reactors and other controversial plants operating when other cheaper and cleaner choices may in fact be available. That is what is happening with Exelon’s aging and expensive Ginna reactor in New York, which is “needed” only rarely (some would argue never, since the need could quickly and easily be met with inexpensive renewables), but regulators have implemented a sweetheart deal to keep it running–a deal now being challenged by clean energy activists.

While it’s not known at this point whether any such transmission constraints are in play at Quad Cities, most experts seem to think that Exelon will be announcing within the next few weeks its permanent shutdown, probably by 2017. A similar announcement could come for Clinton if the Illinois legislature does not quickly act on Exelon’s repeated demands for a bailout of its reactors. So far, the legislature has balked at Exelon’s demands, but the company is continuing its all-out lobbying effort. The auction results could actually hurt Exelon’s position, however, since–in an effort to support big coal and nuclear plants–PJM set the terms of the auction so that more of them could qualify. And that means higher electricity prices for ratepayers–in this case 37% higher. It will be a hard sell for Exelon to convince legislators to now cause rates to rise even more.

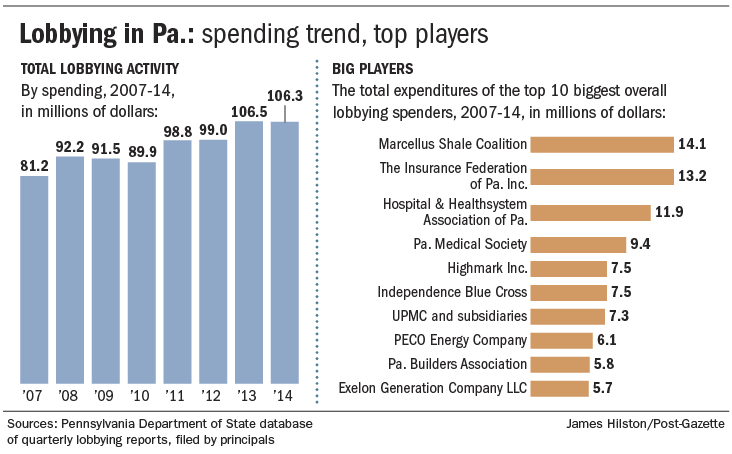

It seems that Exelon sees a similar dynamic developing in Pennsylvania where, as the graph to the right indicates, the company (and its Philadelphia Electric subsidiary) has ramped up its lobbying spending in recent years. Added together, its spending ranks fourth on the list, behind only the frackers of the Marcellus Shale Coalition and two health care insurers. It may be that a legislative-imposed ratepayer bailout for Exelon’s Three Mile Island reactor will be high on the company’s wish list this year.

For its part, Exelon’s Oyster Creek reactor in New Jersey already is set to close in 2019. The auction results make it more likely that the reactor will close earlier than that and certainly anything, such as NRC post-Fukushima regulations, that would force Exelon to have to spend money on the reactor would send it into a speedy retirement.

Meanwhile, Exelon has released some new documentation about the finances of its nuclear fleet and this article from Saturday’s Crain’s Chicago Business provides some details about those finances, as well as how the electricity markets work. Left unanswered however, is the deeper question: how is it even possible that paid-for nuclear reactors’ operating costs are so high that they cannot compete with other generating sources like wind and gas? Nuclear power was sold as a technology that yes, might be expensive to build, but whose fuel and operating costs would be so low that nothing else could compete. In reality, even with low fuel costs, the costs of merely operating and maintaining aging reactors are proving too high to keep them running. The miserable economics of nuclear power are coming home to roost.

The problem is not Exelon’s alone, of course. Entergy has several reactors in the same position–indeed, it was when Entergy first decided not to even enter its Vermont Yankee reactor into the Northeast’s annual capacity auction a few years ago that activists saw its shutdown writing on the wall. And Ohio’s FirstEnergy is desperately seeking re-regulation of that state’s electricity sector as a means of bailing out its perennially-troubled Davis-Besse reactor and a few coal plants to boot. That probably isn’t in the cards, although the utility’s request from the public utility commission for a bailout is still pending, but it has made FirstEnergy somewhat of a poster child for the epitome of the obsolete 20th century utility model–one whose time is quickly passing by.

All of these utilities, and the nuclear trade associations, had been hoping the Clean Power Plan would set up a new means to bail out these uneconomic reactors. But with the EPA turning its back on existing reactors and withdrawing even the limited support for them its draft plan had held out, that avenue is a dead-end.

So, it looks to be bye, bye Quad Cities. And more may be following soon, as the U.S. finally begins to move toward a clean energy future.

Michael Mariotte

August 24, 2015

Permalink: https://www.nirs.org/three-exelon-nuke-sites-fail-to-clear/

Your contributions make publication of GreenWorld possible. If you value GreenWorld, please make a tax-deductible donation here and ensure our continued publication. We gratefully appreciate every donation of any size.

Comments are welcome on all GreenWorld posts! Say your piece. Start a discussion. Don’t be shy; this blog is for you.

If you’d like to receive GreenWorld via e-mail, send your name and e-mail address to nirs@nirs.org and we’ll send you an invitation. Note that the invitation will come from a GreenWorld@wordpress.com address and not a nirs.org address, so watch for it. Or just put your e-mail address into the box in the right-hand column.

If you like GreenWorld, help us reach more people. Just use the icons below to “like” our posts and to share them on the various social networking sites you use. And if you don’t like GreenWorld, please let us know that too. Send an e-mail with your comments/complaints/compliments to nirs@nirs.org. Thank you!

GreenWorld is crossposted on tumblr at https://www.tumblr.com/blog/nirsnet

Reblogged this on nuclear-news.

Reality prevails…Thank you very much. The women and men who built our country used the same bedrock principles. When a process/item costs too much to operate…stop using it. Exelon needs to know when Kodak ( In Rochester N.Y.) went out of business a few years ago, Kodak laid off 45,000 people. This I learned listening to a Nat. Public Radio story a few months ago. The towns and municipalities will get thru the loss of tax money, workers $ and the rest. It will not be easy…but get thru it they will. No one will starve or go without. Laid off people will either stay or move away and work else where. They are all skilled. Now we will really see what the Exelon managers are made of. Will they be first rate managers/stewards of the tons & tons of the irradiated metals/nuclear wastes or leave those “products” for a generation in the future to have to clean up for them ???