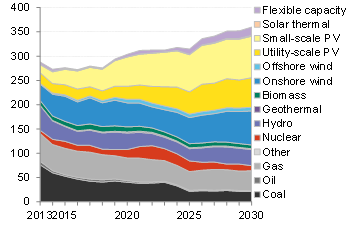

A new report from Bloomberg New Energy Finance (BNEF) projecting world investment in energy technologies through 2026 sees a sharp rise in solar and wind power throughout the world by 2030.

In the Americas (North, Central and South America) alone, Bloomberg predicts energy investment of $1.3 trillion through 2026 (Bloomberg picked that date for investment to assume operation by 2030) and a 28% share of non-hydro renewable energy capacity by that date. The share in the U.S. will be even higher.

Globally, Bloomberg projects a 7.7 trillion investment in new energy capacity, with about two-thirds of that going to renewables. That, says Michael Liebreich, chairman of BNEF’s advisory board, mean that global CO2 emissions will stop growing by the end of the next decade. That milestone would occur even faster if fast-growing developing countries slowed their additions of fossil fuel capacity. Government policies could also change the emissions projection if implemented in time.

Overall, Bloomberg expects about 5,000 Gigawatts of new electric generating capacity globally by 2030, with about 20% of that being fossil fuels. Outside Asia, most of that will be gas, but within Asia, much of it will continue to be coal. Most of the rest will be renewables–in China, fully 72% of energy investment is expected to be made in wind, solar and hydro. About half of the total energy investment will be in Asia, where BNEF expects 800 GW of new solar power alone.

“The period to 2030 is going to see spectacular growth in solar in this region, with nearly 800 gigawatts of rooftop and utility-scale PV added,” Milo Sjardin, BNEF’s head of Asia Pacific, said in the report. “This will be driven by economics, not subsidies, as our analysis suggests that solar will be fully competitive with other power sources by 2020.”

New nuclear power is barely a sidenote in the report; indeed, Bloomberg expects the share of nuclear power to drop slightly during this period, from 6% of global capacity to 5%. Meanwhile, the report says that solar and wind power will increase their share of global generation to 16% by 2030, compared with the current 3%.

In the Americas, BNEF sees the highest amount of new investment in gas, at a projected $314 billion. Rooftop solar comes in next, at $231 billion and BNEF projects that rooftop solar alone will provide 10% of U.S. electrical capacity by 2030. Somewhat surprisingly, BNEF believes there will be 10 GW of net new nuclear power in the U.S. by 2030, after accounting for the shutdown of some existing reactors. That would be at least 10 new reactors, but still less than 1% of U.S. generating capacity by 2030. Five of those reactors (Vogtle, Summer and Watts Bar-2) are under construction, but it’s difficult to see what the next five or more would be. We suspect BNEF will prove to be off on that projection and that U.S. nuclear power capacity will experience a net drop from current levels by 2030–and probably a pretty significant fall-off. That would have the additional positive effect of increasing demand for renewables.

Bloomberg projects that generating capacity in Europe will be 60% renewable by 2030. Coal will be the biggest loser in both Europe and the Americas.

These projections could, of course, change over the next few years, and probably will. As BNEF notes, if governments want to decarbonize faster to avoid the worst of climate change, they will have to enact policies to do so–market forces alone are not going to do the job. But if governments do enact such policies–as the U.S. is beginning to do with its new proposed carbon regulations–that could accelerate the already rapid retirement of coal plants, and perhaps force less investment in gas. Adoption of such policies in Asia, especially China and India, could result in less new coal plant construction as well. And the world’s aging fleet of nuclear reactors is likely to experience more safety problems and suffer from increasing operating and maintenance costs over the next decade, which could well lead to an even bleaker future for nuclear than BNEF suggests. And a bleak future for the nuclear power industry is a happy future for everyone else.

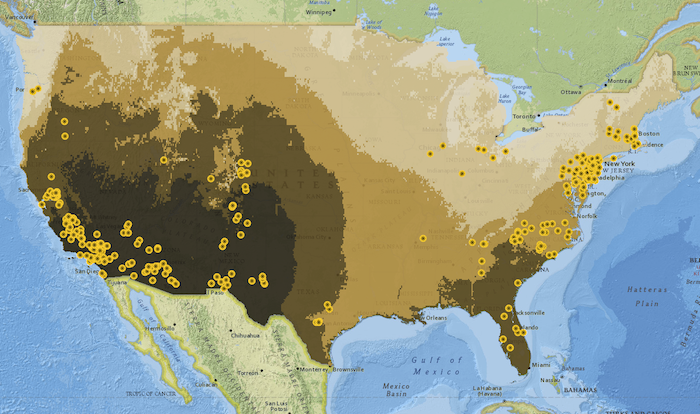

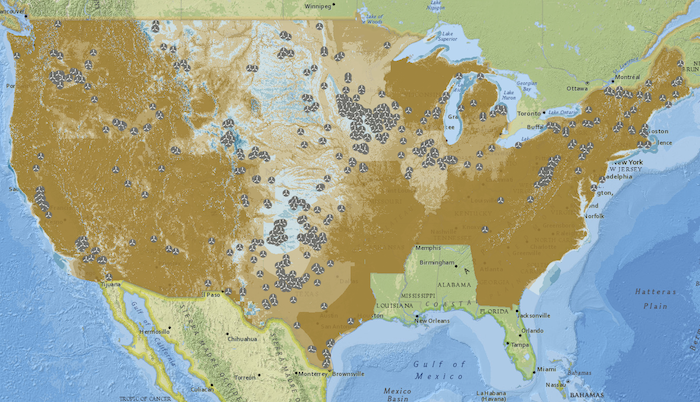

The maps at the top and bottom of this post come from CleanTechnica.com and show the actual placement of solar (power plants, not rooftop) and wind installations in the U.S. compared to potential for each. What’s especially noteworthy to us on the solar map is the extremely untapped areas for solar power–especially in the populated Southeast and Midwest–when compared to other regions. Wind power appears to be more rationally distributed, but there clearly remain many areas with huge onshore wind potential that remain untapped as well. The room for growth for both technologies remains astronomical.

Michael Mariotte

July 1, 2014

Permalink: https://www.nirs.org/2014/07/01/bloomberg-sees-a-renewable-powered-future/

You can now support GreenWorld with your tax-deductible contribution on our new donation page here. We gratefully appreciate every donation of any size–your support is what makes our work possible.

Comments are welcome on all GreenWorld posts! Say your piece above. Start a discussion. Don’t be shy; this blog is for you.

If you like GreenWorld, you can help us reach more people. Just use the icons below to “like” our posts and to share them on the various social networking sites you use. And if you don’t like GreenWorld, please let us know that too. Send an e-mail with your comments/complaints/compliments to nirs@nirs.org. Thank you!

Note: If you’d like to receive GreenWorld via e-mail daily, send your name and e-mail address to nirs@nirs.org and we’ll send you an invitation. Note that the invitation will come from a GreenWorld@wordpress.com address and not a nirs.org address, so watch for it.

By 2030, depletion of fossil fuels – including natural gas – will probably be a LOT more obvious and harder to deny.

Conventional nat. gas is in decline and fracking for gas is either near or at peak, now, so more investment in nat. gas would be a “stranded asset.”

Coal is also in decline more due to geologic limits than policies. Peak Coal in the USA was 1999, in terms of BTUs. It’s even peaked in terms of tonnage. In Pennsylvania, where coal mining started, it peaked in 1920.