That nuclear power’s miserable economics are pretty much killing the industry, especially in the western world, is a reality acknowledged by virtually everyone at this point. After the first burst of reactor construction from the late 1960s until the early 1980s collapsed under the weight of multi-billion dollar cost overruns and lengthy schedule delays, a decade ago the industry argued it had learned and incorporated its lessons and the result would be a nuclear renaissance.

But before even a single reactor launched by this renaissance has begun operating (for a “renaissance that began more than a decade ago, this in itself is a telling point), bloated, untenable costs and delays from Georgia to Finland have again put the kibosh on the notion of any meaningful nuclear expansion in the west. And even in China, where transparency in economic data is literally a foreign concept, there are indications that costs and schedules for new reactors are not exactly meeting expectations.

Meanwhile, nuclear utilities from Illinois to Sweden argue that new subsidies–whether in the form of higher rates or tax relief or direct deposits of taxpayer money to their bank accounts are required to keep long-ago paid-for but aging and obsolete reactors simply operating. Some of this is pure greed, of course, with the utilities just wanting more money and they see an opportunity granted by concern about climate change to get some, but some of it is real. Some of these older reactors, which supposedly benefit from all of nuclear’s purported cost advantages in terms of low fuel costs, operating experience and so on, just can’t compete with newer, cheaper and cleaner technologies.

While it seems that far too many legislators don’t yet understand all this, the nuclear industry itself certainly does, and the number one topic in industry-oriented publications these days is how to turn around its economic miseries.

I wrote about what the industry, at least in the U.S., wants for its uneconomic operating reactors–and its sometimes delusional approaches to achieve those goals, a couple of weeks ago.

But even if it attains the levels of ratepayer/taxpayer subsidies it wants–and it likely won’t–it’s not enough for the industry to simply rescue some dinosaurs from their inevitable extinction. Without new reactors, without expansion, the industry will simply wither away by mid-century. While that would be better for society, better for ratepayers, better even for the climate, that, of course is not an industry perspective.

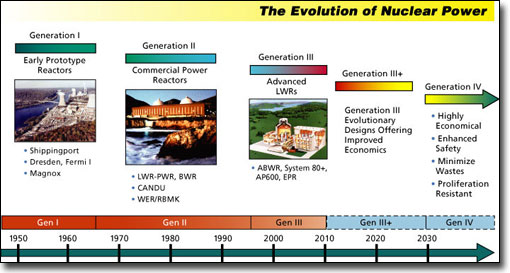

The industry’s typical prescription for its revival revolves around a few key tenets: Build safer reactors–i.e. Generation IV designs; and/or build smaller reactors, which may or may not be Generation IV designs; have more standardization of reactor designs; use modern modular construction techniques; and so forth. And many industry pundits, at least, have derived hope from a recent Breakthrough Institute paper which argues that the industry’s experience in South Korea and elsewhere, including the UK, Germany and Japan, demonstrates that the pattern of ever-escalating reactor construction costs is not inevitable.

Like an apartment-dwelling five year old wanting a horse for Christmas, it’s all just wishful thinking.

So explains, if not in those words, Steve Kidd, a veteran nuclear industry consultant, in a piece in Nuclear Engineering International yesterday that serves as a warning to his industry.

Explains Kidd about the Breakthrough paper, “With the exception of South Korea, these apply only in particular time periods.” In other words, the authors were essentially cherry-picking data to make their case, and it doesn’t hold up when the total picture is examined.

Kidd goes on to explain, “Full data from the UK was conveniently unavailable–the cost escalation record of the 14 AGRs was even worse than the US experience in the 1980s–while the escalating costs of the two EPRs under construction in Europe and the four AP1000s in the US are also ignored. Had Chinese data been available, it would almost certainly back up the South Korean record with little or no cost escalation. This has, however, been reversed in the latest imported foreign designs in China, and it will be interesting if the latest larger Korean 1,400MW units can maintain the favourable cost record of the previous generation of local 1,000MW units.”

At best, the Korean experience shows cost escalation is not inevitable everywhere all the time. That’s a small thread on which to hang a mega-billion dollar industry.

Kidd also argues that new, safer reactor designs are essential if there is to be any chance of winning over the public, which he acknowledges is fearful of nuclear power. But, Kidd points out, “innovation is expensive.”

Kidd concludes with his recommendations, written from a UK perspective but applicable everywhere, but doesn’t sound too optimistic about their implementation:

Ultimately, as I have said before, the world must move to a small number of reactor designs that can be built cheaply in large numbers, using a fully internationalised supply chain. In normal industries this would come about by natural wastage of unsuccessful companies being taken over by those who are thriving and profitable, but this currently seems a forlorn hope in nuclear. National governments see nuclear as a strategic industry and will not let jobs wither away to competitors. Selling nuclear reactors to other countries becomes an arm of foreign policy. This will merely lead to a continuation of the current situation, where there are too many reactor designs offered by lots of different companies, all with a small number of orders and all of which are too expensive. It is doubtful if some of today’s designs can be built anywhere economically.

In other words, the notion that new nuclear power could potentially be economically competitive is not entirely absurd, at least in a fantasy world where everything went exactly as the industry needs. But in the real world, the idea that nuclear power will become economically competitive with the safer, cleaner and cheaper energy sources and technologies of the 21st century is simply wishful thinking.

Michael Mariotte

March 28, 2016

Permalink: https://www.nirs.org/wishful-thinking…s-of-new-nuclear/

Your contributions make publication of GreenWorld possible. If you value GreenWorld, please make a tax-deductible donation here and ensure our continued publication. We gratefully appreciate every donation of any size.

Comments are welcome on all GreenWorld posts! Say your piece. Start a discussion. Don’t be shy; this blog is for you.

If you’d like to receive GreenWorld via e-mail, send your name and e-mail address to nirs@nirs.org and we’ll send you an invitation. Note that the invitation will come from a GreenWorld@wordpress.com address and not a nirs.org address, so watch for it. Or just put your e-mail address into the box in the right-hand column.

If you like GreenWorld, help us reach more people. Just use the icons below to “like” our posts and to share them on the various social networking sites you use. And if you don’t like GreenWorld, please let us know that too. Send an e-mail with your comments/complaints/compliments to nirs@nirs.org. Thank you!

GreenWorld is crossposted on tumblr at https://www.tumblr.com/blog/nirsnet

Reblogged this on nuclear-news.